How Rates of Return Affect Required Pension Assets

While pension finance is a relatively obscure discipline that requires of its practitioners expertise both in investments and actuarial calculations, it is a mistake to think the fundamentals are beyond the average policymaker or journalist. One policy question of extreme importance to discussions about the future of public worker pensions is how much pension funds can legitimately expect to earn over the long term. The reason this question is critical is because the more the pension fund earns, the lower the annual contribution will have to be. Just how much lower each percentage point gain offers is startling.

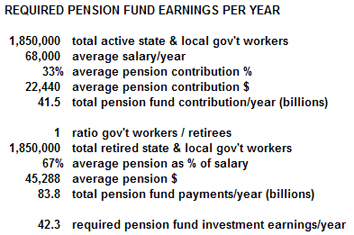

In the first table (below), conservative assumptions are offered towards estimating how much the pension funds of California’s state and local workers must earn each year. The number of active state and local government workers is fairly well documented at 1.85 million (including K-12 and higher education). The $68,000 per year annual salary is actually low, since that is the average salary, and pension fund calculations are based on the higher final salary. This means the $68,000 figure is accurate for estimating the money flowing into the pension system, but will understate the amount of money flowing out of the pension system to retirees. Similarly, the 33% average pension fund contribution is on the high side – typically only public safety employees, who are only about 15% of the state and local government workforce, contribute amounts over 30% of their salary into the pension funds. But based on these numbers, each year California’s state and local workers pour $41.5 billion into the state and local government worker pension funds.

The second half of the table (above) estimates how much money comes out of the state and local government pension funds each year. This projection shows a ratio of retirees to active workers of 1-to-1, based on the assumption that – using full-career-equivalent workers and retirees – the average worker is employed for 30 years, and is then retired for 30 years. This is an important concept to linger on, because the concept of “full-career-equivalent” is crucial to understanding why CalPERS spokepeople are accurately able to claim the “average” pension is only $25,000. In reality, that is only true when considering all employees who ever passed through the CalPERS system – even if they only worked for five years and barely vested a pension.

This concept also applies when calculating the “average pension as percent of salary,” where based on existing pension formulas, 67% is on the low side when dealing with full-career-equivalent numbers. Typical government pensions in California accrue between 2.0% and 3.0% per year – teachers, who are 40% of the public workforce, who work 30 years receive 2.5% per year, public safety workers, who are 15% of the workforce, receive 3.0% per year. It is common for public utility workers to receive 2.7% per year. So estimating an average pension of $45K per year, based on 67% of $68K, is almost certainly on the low side. This means California is projected to pay out $83 billion per year to their retired state and local workers. In reality, current formulas and data suggest they will pay out a lot more than that.

The point of the first chart is that the money going into the government worker pension funds in California is estimated to be $41.5 billion per year, and the amount of money being paid out of these pension funds to retired state and local government workers is projected to be $83.8 billion per year. This means $42.3 billion per year will have to be earned on the market through investment returns.

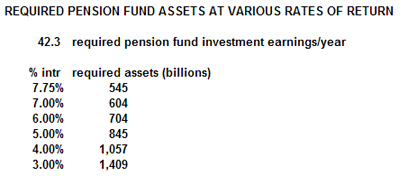

The second chart (below) shows what the necessary asset balance is based on various rates of return. The calculation is extremely straightforward – take the amount that has to be earned each year, and divide that amount by the rate of return the fund is going to deliver:

As can be seen, at a rate of return of 7.75%, which is CalPERS (and most other government worker pension funds) official long-term projected rate of return, “only” $545 billion in assets are necessary for these funds to be “fully funded.” But if this rate of return is dropped by a few percentage points, the necessary assets mushroom. What if pension funds were required to stop making risky investments and instead had to buy treasury bills? Don’t be surprised if that is necessary someday – for example when nobody else will buy T-bills… What an elegant solution to the challenges posed by quantitative easing. But California’s pension funds would go from being fully funded at $545 billion to being only 39% funded – and the necessary asset balance would increase by $864 billion to $1.4 trillion.

The reason we don’t hear more about the serious discussions over what the real long-term rate of return should be for these massive funds is because they are occurring behind closed doors, and the reason for that should be clear by studying the above table. How on earth would Californian taxpayers cough up $864 billion? How and when will the actuaries and investment experts deliver this shock to the system?

Because current pension benefits have a cost-of-living-adjustment cap of 2% that is lifted as soon as the purchasing power of the pension benefit erodes to between 75% and 80% of the original award, don’t expect inflation to bail out the government worker pension system. Even more alarming than the nominal projection of 7.75% used by CalPERS is their real rate of return – they assume 3.0% inflation and expect an inflation-adjusted return of 4.75%. That may have been possible in the days when asset bubbles were inflating which collateralized what is now $50 trillion in debt (commercial, household and government combined) in the U.S., but those days are done.

Even if pension funds – that in aggregate in the U.S. currently manage about $3.0 trillion in assets – could earn a 4.75% (long-term, after inflation) return, they would do so by beating the market. This means other market participants, i.e., individual small investors with their 401Ks, would lose. This predatory relationship between large public sector pension funds and the small investors is ignored by apologists for public sector pension funds, who both claim “Wall Street” is to blame for the 2007 market crash, yet rely on Wall Street to deliver for them, decade after decade, higher than market rates of return.

Finally, if taxpayers are to fund market investments for the purposes of augmenting the retirement assets available to workers in the United States, it should be for ALL workers, not just government workers. As it is, however, the existence of gigantic, aggressively managed funds whose entire risk is borne by taxpayers creates a dangerous distortion in the investment market. It is ridiculous that in an era of unavoidable debt reduction, when the federal composite borrowing rate is less than 1% per year, taxpayer supported Wall Street entities – i.e., government worker pension funds – are claiming they can earn 7.75% per year. The longer they cling to this fiction, elevating their portfolio risk to achieve the unachievable, the more volatile the entire market will become.

Policymakers have to face the fact that when these projected rates of return come down, and they will, government worker pensions as they are currently formulated will disappear. Hiding behind the “complexity” of this issue, and instead echoing the sanguine talking points of CalPERS spokespersons who have not sat in the closed door meetings, is simply irresponsible.

Edward Ring is a contributing editor and senior fellow with the California Policy Center, which he co-founded in 2013 and served as its first president. He is also a senior fellow with the Center for American Greatness, and a regular contributor to the California Globe. His work has appeared in the Los Angeles Times, the Wall Street Journal, the Economist, Forbes, and other media outlets.

To help support more content and policy analysis like this, please click here.