Teachers Union Promotes Property Tax Increase

Last week what is arguably California’s most powerful political special interest, the California Teachers Association (CTA), or teachers union, held its quarterly State Council of Education meeting at the plush Westin Bonaventure Hotel in downtown Los Angeles.

The CTA reported revenues of $209 million on their most recent IRS Form 990 (results through 8/31/2018), and their total assets increased from $296 million to $334 million. The CTA’s “savings and temporary cash investments” increased from $56 million to $79 million during their most recent year of operations.

Even here in California, these are astonishing sums of money. Moreover, the CTA, operating statewide, only wields about half of the teachers union’s financial firepower deployed in California. Additional financial resources come from the CTA’s national affiliate, the National Education Association, as well as from the dozens of major local affiliates, such as the United Teachers of Los Angeles.

Getting Rid of Proposition 13 Protection for Commercial Properties

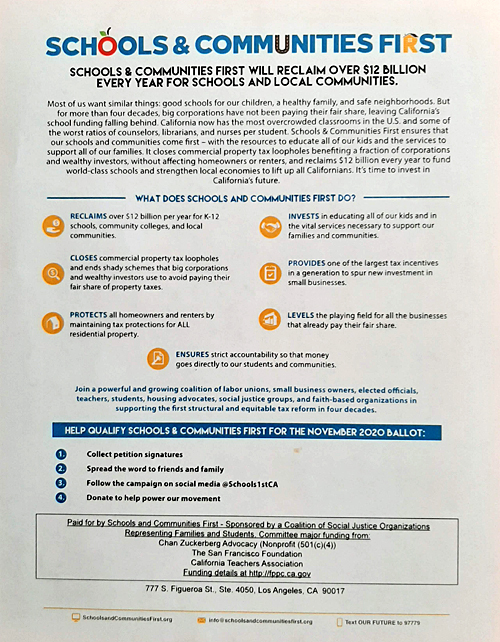

A helpful mole inside the CTA’s recent meeting has provided four examples of what is one of the top priorities for the CTA these days, which is to strip commercial properties of the protections they have enjoyed under Prop. 13. To that end, they have endorsed and are major contributors to the “Schools & Communities First” state ballot initiative, likely to face voters in November 2020.

Since 1978, Prop. 13 has limited property assessments to a maximum of 2 percent increases per year when calculating the base on which to impose property taxes. The only time the taxable base value is reset is when a property is sold. If a business property is inherited, to purposes of property taxation the descendants inherit the base value without reassessment.

Let’s be clear, Prop. 13 protection constitutes one of the last, if not the last, advantage businesses have when trying to operate in California. As this first flyer shows, that last bit of relief businesses get in what is the most inhospitable state in America is not as important as putting “Schools & Communities First.”

A very long time ago, presidential candidate Ronald Reagan famously had this to say about business taxes:

“Some say shift the tax burden to business and industry, but business doesn’t pay taxes. Oh, don’t get the wrong idea. Business is being taxed, so much so that we’re being priced out of the world market. But business must pass its costs of operations–and that includes taxes–on to the customer in the price of the product. Only people pay taxes, all the taxes. Government just uses businesses in a kind of sneaky way to help collect the taxes. They’re hidden in the price; we aren’t aware of how much tax we actually pay.”

In reality, it’s worse than that, because the corporations that will be able to pass on higher costs to the consumer will be the major multinational corporations, the franchises, the chains, whatever outposts of big business that haven’t already pulled out of California.

The victims, that will not be able to pass on higher costs to the consumer when their property taxes suddenly go sky high are the small family owned businesses. Many of these small businesses are multi-generational, and the only reason they have been able to stay in business is because their property taxes are manageable. But have a look at this next flyer.

According to the CTA, the “Schools and Communities First” Act will “level the playing field for all the businesses that already pay their fair share.” Wrong. It will tilt the playing field in favor of the mega-corporations, taking away the last advantage of the little guys.

The dirty secret that the CTA in particular and California’s one-party political establishment in general don’t want voters to know is that over-regulation helps big business. The biggest, most financially secure businesses use regulations to consolidate their position at the top, while the smaller competitors die off because they can’t to afford to comply.

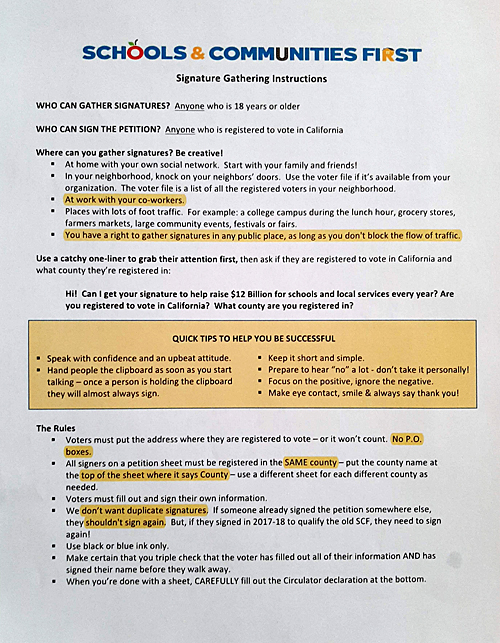

If you’re wondering how the CTA intends to get the “Schools & Communities First” Act onto the ballot, have a look at this next flyer. There’s big money behind gathering signatures, but in Los Angeles last week the CTA was making sure every available activist had a chance to get personally involved.

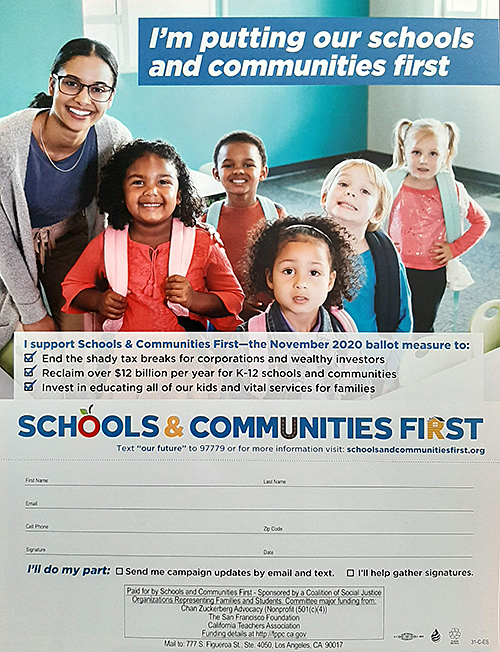

How could anyone refuse this pitch? Look at the boxes that are prechecked: “End the shady tax breaks for corporations and wealthy investors.” Too bad the biggest ones are the least harmed by this change in the law, while the mom and pop businesses are going to drop like flies.

As for “Reclaim over $12 billion per year for K-12 schools and communities,” well, that’s right, the estimated annual proceeds of $12 billion – 100 percent of which will be passed on to consumers in the form of higher prices – will be thrown into the maw of California’s public education budget.

The problem with this is simple: The educational policies supported by the CTA are not going to improve education. In fact one might say it is the educational policies supported by the CTA that have grossly undermined the quality of K-12 public education in California. So we’ll give them more money with no change in these policies?

This next flyer shows the reach of the CTA, enlisting an army of teachers and other school employees to actively solicit signatures for the “Schools & Communities First” Act. But it’s important to note that the CTA, and the PAC it supports, does not need volunteer assistance.

According to the California Fair Political Practices Commission, the “top aggregated contributions” for the “Schools & Communities First” Act, Measure # 1864, already has collected $11.5 million, which even these days should be sufficient to pay professionals to gather the requisite signatures.

What Ought to be Preconditions for Increasing School Funding?

The problem with opposing measures like this is rooted in the very human and very virtuous urge most people feel to do the right thing. Who opposes something that will “help the children learn?” Who doesn’t want teachers to receive a “living wage?” The answer, of course, is that nobody apart from the most hardened misanthropes would ever oppose these things. The problem is that the educational policies the CTA pushes are not going to help the children learn, and the pay increases they want to give the teachers will not reward the best teachers.

For example, whether or not all public school teachers are underpaid is debatable, but clearly the finest teachers are underpaid, because the union work rules do not sufficiently reward the finest teachers. The Vergara case, not even heard by the California Supreme Court based on a technicality, offers compelling evidence of the damage caused by these work rules.

In the case, which challenged statutes governing layoff, dismissal, and tenure policies, the plaintiffs argued that by favoring seniority over merit in layoffs, by making it extremely difficult to fire incompetent teachers, and by awarding tenure after barely a 1.5 years of classroom observation, students were denied quality education. Moreover, the negative impact of these statutes had a disproportionate impact in low income communities. Watch the plaintiff’s closing arguments, made six years ago in a Los Angeles courtroom, to see how persuasive those arguments were and also to realize how much California’s students lost when that case died.

California’s teachers should be paid more when California’s teachers are truly held accountable for their performance and when incompetent teachers are fired.

One may argue endlessly about the effectiveness of union work rules, just like one may argue about Common Core and a host of other curricula that are, depending on who you ask, either necessary preparation for life in the 21st century or divisive and destructive indoctrination. But it wouldn’t matter if parents had a choice about where they send their children to school.

And this brings us to the other big issue, school choice. The CTA opposes expansion of charter schools, making the dubious claim that charter schools take money away from traditional public schools. The problem with that claim is that if the charter schools were defunded, returning that money to the traditional public schools, the charter school students would also return to traditional public schools, making crowded classrooms even more crowded. For much more on the fallacy that charter schools damage the finances of traditional public schools, read “Modest Strike Settlement Nonetheless Puts LAUSD in Even Worse Financial Shape.”

Moreover, why should charter schools, which compete for students, permit diverse educational strategies, and leave power in the hands of fully accountable principals to hire and fire teachers, be the only solution? Why are school vouchers considered a third rail by education reformers as much as by the opponents of vouchers? Why? Why not allow parents to receive vouchers that they can use to pay for their children to go to any accredited school they want, whether it’s public, private, charter, parochial, or home schooling? Why should parents whose children could never thrive in a traditional public school pay taxes to support those schools, then also have to pay tuition for private schools?

The bottom line with the California Teachers Association is that it does not want teachers or schools to be held accountable for their performance, much less to compete for students. They just want more money.

This article originally appeared on the website California Globe.

* * *

Edward Ring is a contributing editor and senior fellow with the California Policy Center, which he co-founded in 2013 and served as its first president. He is also a senior fellow with the Center for American Greatness, and a regular contributor to the California Globe. His work has appeared in the Los Angeles Times, the Wall Street Journal, the Economist, Forbes, and other media outlets.

To help support more content and policy analysis like this, please click here.