Who Wins and Who Loses in the Bubble Economy?

Earlier this month the California Policy Center released a study that provided additional evidence that the U.S. stock indexes are overvalued by approximately 50%, along with calculations showing the impact of a major downward correction on the solvency of California’s state and local government pension systems. Stocks are now at unsustainable bubble valuations.

Not covered in this study, but equally overvalued, are bonds, which pension systems misleadingly categorize as “fixed income” investments in their portfolio disclosures. CalPERS even went so far as to trumpet their success in earning a 9.29% return on “fixed income” investments in their most recent press release – a healthy return that offset losses elsewhere and allowed them to earn a marginally positive return of 0.61% last year. But “fixed income” investments usually refers to bonds, and bonds are also at unsustainable bubble valuations.

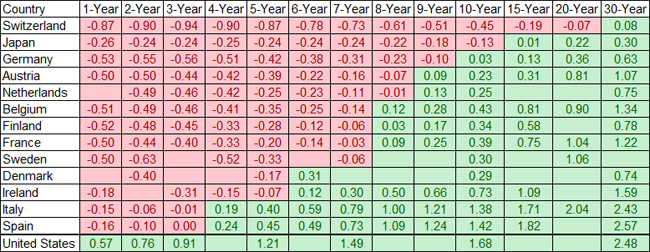

Here’s why bonds are overvalued today: Whenever new bonds are issued at lower fixed rates of interest than the bonds that were issued before them, then those older bonds that pay higher fixed rates of interest can be sold for more money than their original price. This is because on an open market, buyers will price a resold bond at a value calculated to equalize returns. When rates go down for new bonds, the prices for existing bonds go up. The problem is that back in the 1980’s, bonds were being issued at rates as high as 16%, and today, they’re being issued at rates close to zero. After a thirty year ride, interest rate drops can no longer be used to elevate the value of bond portfolios.

At a macroeconomic level, every possible investment in the world is overvalued today, because central banks have lowered interest rates to zero in a desperate attempt to continue a decades long disease in which they have spent more than they’ve collected. Governments got to borrow money for next to nothing, and assets kept appreciating. But the binge is almost over, and unlike the savvy super-rich, pension funds can’t just take their winnings off the table.

New Bond Issues, Rates by Nation – June 2016 (red = negative)

Negative coupon bonds, a desperate experiment that isn’t going to end well.

Negative coupon bonds, a desperate experiment that isn’t going to end well.

This is all tedious drivel, however, if you are a unionized public employee in California. Your retirement security is guaranteed by “contract.” It’s the result of deals cut between union “negotiators” and the politicians they make or break. As a government employee in California, if you’ve worked 30 years, the average annual retirement benefit you can expect if you retire this year is worth over $70,000. To honor that expectation, CalPERS is already mid-way through their latest reassessment, a 50% increase to their collections from participating agencies. And if there is a 50% market correction (“fixed income” and equity), expect them to double or even triple their collections from taxpayers.

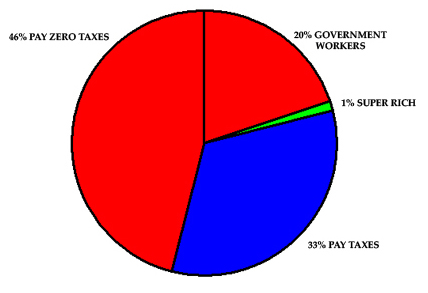

If you are a private citizen trying to prepare for retirement today after, say, 45 years of work and saving, good luck. Because there is no safe investment left in the world. And while you are likely to have to cope with, for example, suspended dividend payments on stocks that are down 50%, expect your taxes to go up in every imaginable category – sales, property, income, and hidden taxes embedded in your utility bills and phone bills. It will be “for the children” and “for public safety.” And if there’s a vote required to increase the tax, it will usually pass, because most voters don’t pay property tax, or income tax, or if they do, the taxes are indirectly assessed and invisible to them.

This is the oppressive hoax that government unions have perpetrated on the working families they claim they want to protect. They have exempted their own members, government workers, from the consequences of a corrupt financial system where they are leading partners. When governments spend more than they make and have to borrow money, central banks lower interest rates to make it easier to work the payments into the budget. At the same time, lower interest rates goose the value of stocks and bonds, helping the pension funds claim they can earn 7.5% per year. And when the house of cards collapses, taxpayers bail out the banksand the government pension funds.

The next time a spokesperson for a government union speaks disparagingly about Wall Street corruption, remember this: They are partners with Wall Street. They support overspending for their own compensation and benefits, creating deficits that have to be covered by taxes and borrowing. Their pension funds demand high returns, and the bankers comply, with rates that encourage borrowing and deny ordinary people the ability to save. Now that interest rates have hit zero and are even going negative in an exercise of monetary chicanery that has no rival in history, the end is near.

Public sector union leaders need to start remembering they represent public servants, not public overlords who are exempt from the reality that you can only spend as much as you earn. As it is, these union leaders are the overpaid mercenaries of capitalism at its most corrupt.

* * *

This article originally appeared on the website of the California Policy Center.

Edward Ring is a contributing editor and senior fellow with the California Policy Center, which he co-founded in 2013 and served as its first president. He is also a senior fellow with the Center for American Greatness, and a regular contributor to the California Globe. His work has appeared in the Los Angeles Times, the Wall Street Journal, the Economist, Forbes, and other media outlets.

To help support more content and policy analysis like this, please click here.